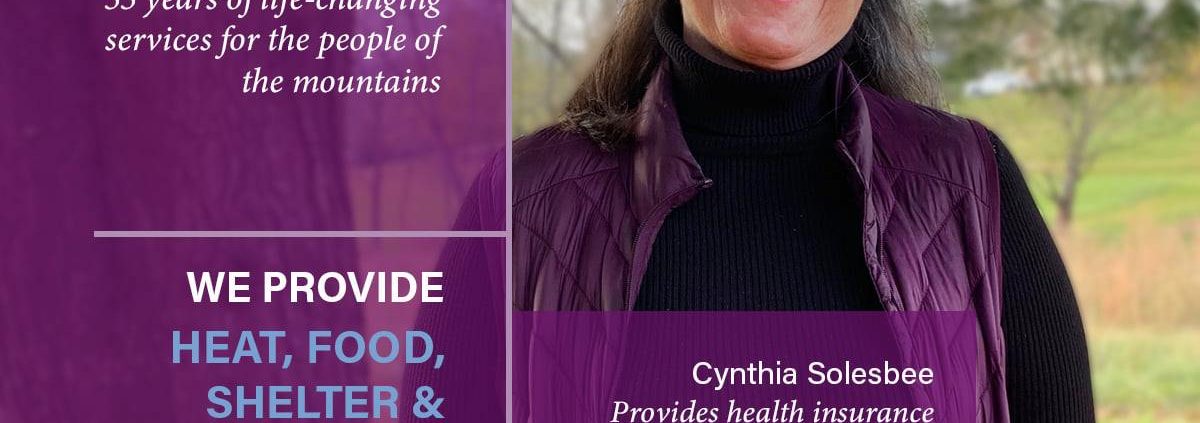

We, Mountain Projects: Cynthia Solesbee

We, Mountain Projects is a gallery of staff going above and beyond to serve their community.

Founded as a Community Action Agency in 1965, Mountain Projects has a 140 person staff and serves the community with 21 different programs.

Many staff of Mountain Projects have served the organization for decades, including Executive Director, Patsy Davis, “Mountain Projects staff bring their hearts and their expertise to work everyday and together, we make western North Carolina a better place to live for the entire community. I like to think of our staff as heroes and I don’t think of that as an exaggeration.”

Cynthia Solesbee’s client, a Haywood County farmer, suffered catastrophic injuries in an ATV accident a few years ago. After helicopter rides, brain surgeries and rehabilitation, she was presented with a bill that exceeded one million dollars.

Her family was distraught. “We’ll have to sell our farm to pay for this!” her husband said.

Fortunately, Cynthia, in her role as a Certified Application Counselor for health care insurance at Mountain Projects, had earlier convinced her to enroll in health insurance under the Affordable Care Act, and had guided her through the process. As a result, the total payout for the family was less than $1,000.

Here’s the story in Cynthia’s words:

“When the Affordable Care Act started in 2014, I ran into a friend at a Christmas party and convinced her to come in to see her options of health insurance coverage.

She’s a farmer, and at first, didn’t see the value of having health insurance, but she did finally decide to enroll.

That November in 2014, near Thanksgiving, she was headed to a friend’s house on her ATV when the ATV hit a large hole and flipped over on top of her. She was unconscious, and thankfully, her husband found her before she bled to death. She had a brain injury and numerous broken bones. MAMA took her to Asheville where she underwent several brain surgeries and was subsequently put in an induced coma.

I knew I had to re-enroll her for 2015, so I received permission to have her husband enroll her. I went to the waiting room at Mission hospital in Asheville, to enroll her, and met her husband. The first thing he said to me was, with a worried look on his face, “Cynthia, we’re going to have to sell our farm to pay for this!”

I explained that the most they would have to pay out of pocket during the whole year would be $750! Her hospital bill was well over a million dollars due to the number of brain surgeries, and then the amount of rehabilitation she would need. She’s doing great now. She still has her farm and she makes the best chèvre cheese from goat’s milk I’ve ever tasted. She still tells me often that she is so thankful she took my advice to look at the insurance. It saved their farm.”

Leave a Reply

Want to join the discussion?Feel free to contribute!